How You Can Lose $393,000 - or More

With the WRONG Hybrid Product Choice!

— Craig Davis, on December 20, 2016

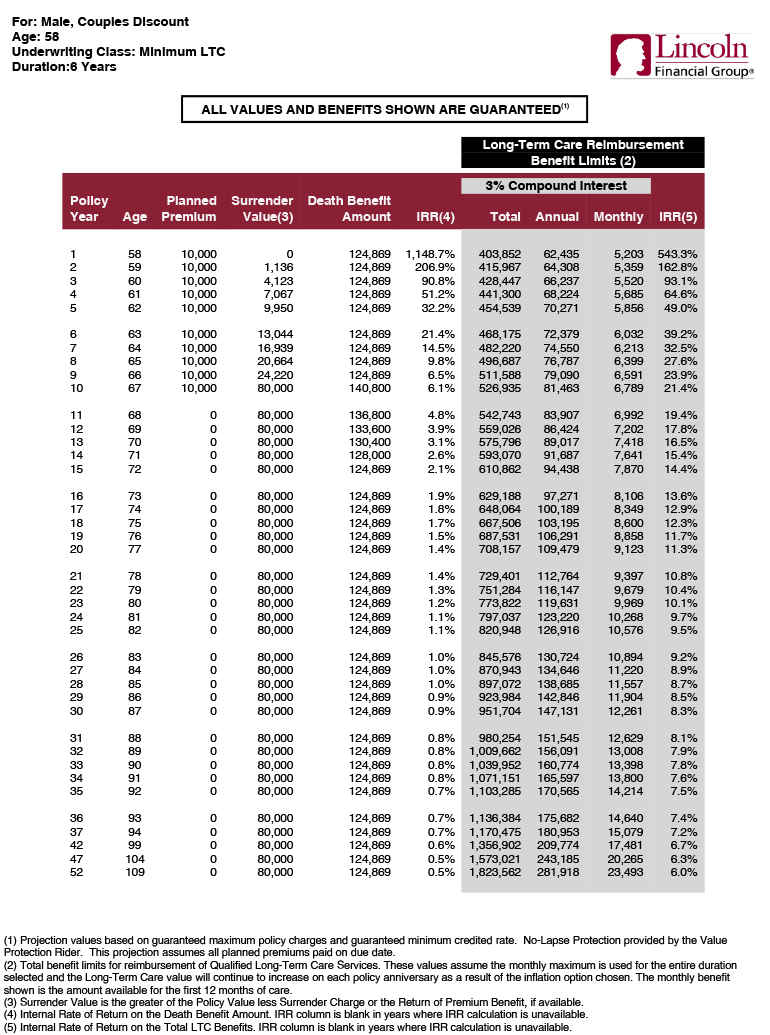

Often in the hybrid world the wrong product choice- or plan design choice- could cost you a substantial amount of money down stream. The purpose of this month’s commentary is to explain why. Two product choices (Lincoln Financial and Pacific Life) are presented to a 58 year old male. In the first example (MoneyGuard) the proposed insured deposits $10,000 per year for 10 years. After that period, in the surrender value column, he can retrieve 80% of that amount, or $80,000, should he want his money back. In year 33, at age 90, there is a $1,039,952 pool of money available should he need long-term care.

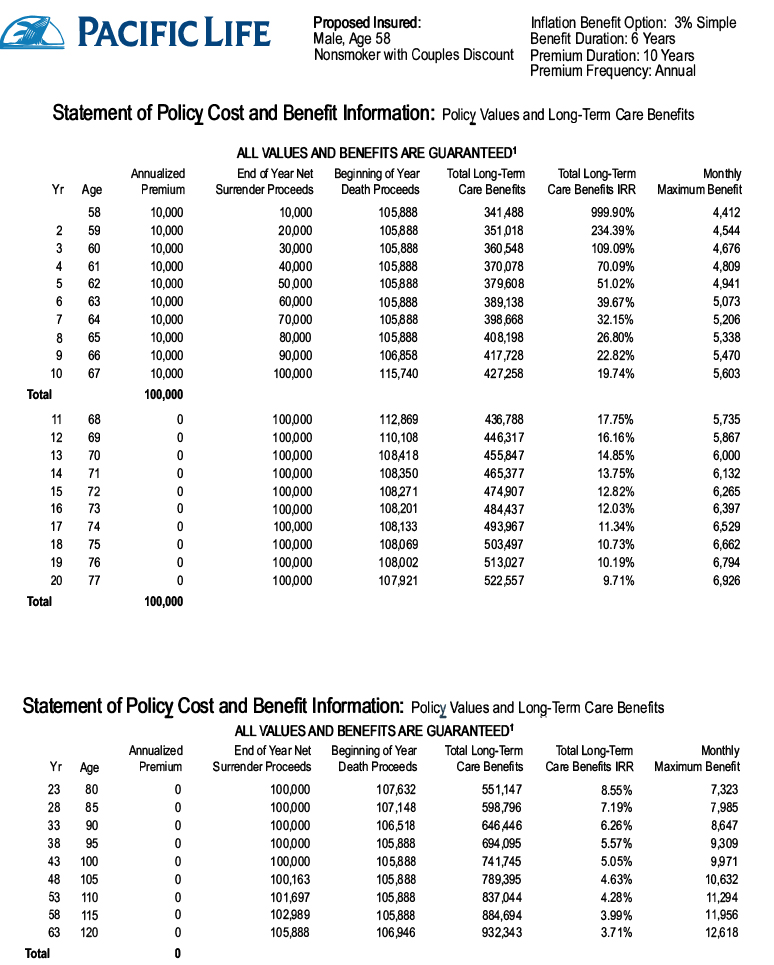

The second product choice, Premier care Advantage from Pacific Life, is presenting a different story. The same $10,000 per year is contributed for 10 years, but $100,000, not $80,000 is available should he want or need his money back At age 90 there is a $646,446 pool of money available for long-term care. This is a remarkable $393,000 difference in benefits available for care from the two product choices!

This is why it is incumbent for the savvy buyer to use a professional well versed in product and plan design differences. The wrong choice, in this case, could cost $393,000 dollars. Now to be fair the 100% money back offer, not 80%, could be more important to the buyer. But the point is that all bases should be covered so the buyer can make an informed decision.