AnnuitiesOption

Annuity Solution

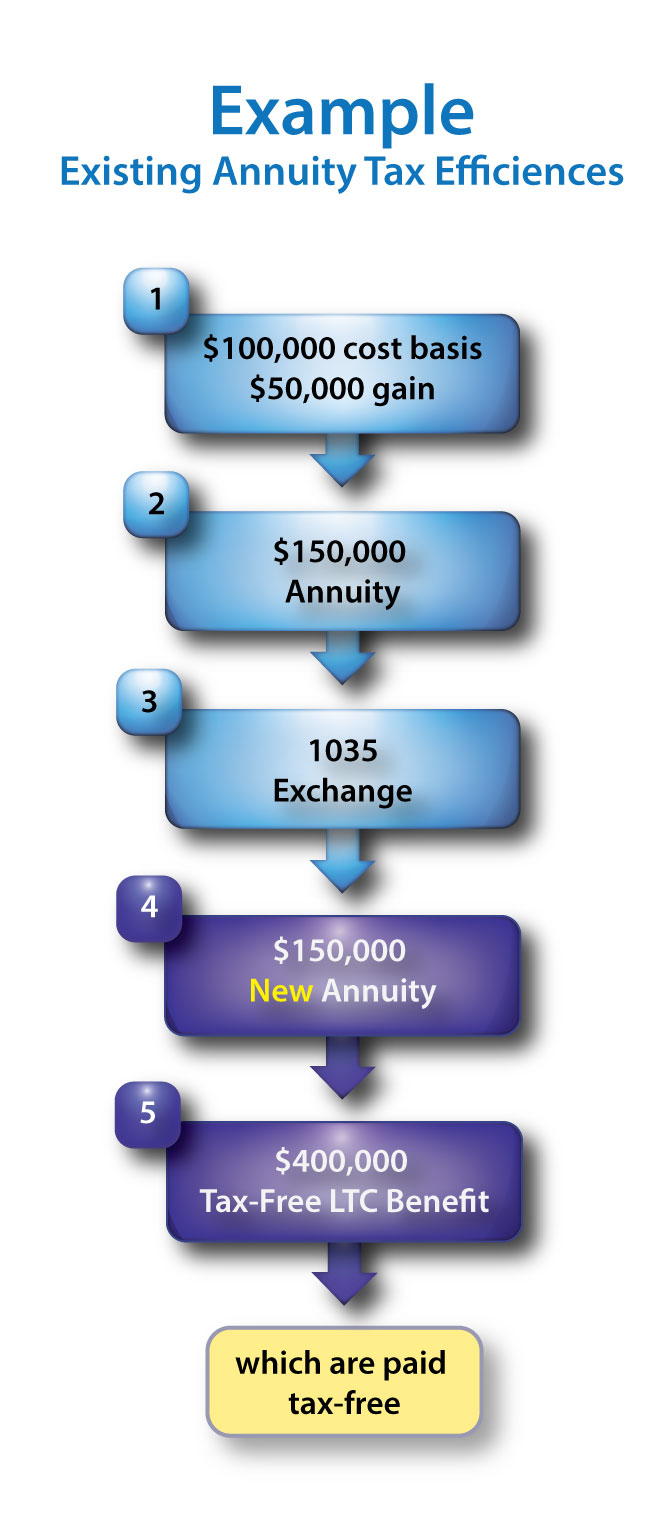

Annuities with long-term care benefits also provide an extremely tax efficient mechanism with which to self insure long term care and provide asset protection.

Often these annuities require no additional premium expense because you would reposition assets from underperforming cd’s, money market accounts or rainy day savings accounts. Perhaps most importantly, you can 1035 exchange existing annuity assets (and gains) tax free into a new annuity with long-term care benefits. LTC benefits from the annuity are paid tax free.

If you never use long-term care benefits your annuity is still available to you. If you don’t use it- you don’t lose it.

Tax Benefits and the Pension Protection Act

There is a premium cost associated with the additional long-term care insurance provided through the annuity. This premium is paid, tax free, from your annuity as a distribution. Most importantly, this premium cost is far less than premiums associated with traditional long-term care insurance. This is because your deductible, or elimination period, is longer. Your annuity value is used before the insurance benefit begins to pay for care. But under a self insure strategy, you would have used this money anyway to pay for care. With our strategy your annuity is leveraged many times (2X to 5X or more) to pay for care.